Organizing and filing expense receipts isn’t always the job of choice for most business owners. It is, however, necessary for good bookkeeping. Keeping receipts for all your business expenses not only allows you to claim tax deductibles. It also serves as evidence for costs and purchases made by your business.

You can use expense receipts to prepare financial statements and track your business spending. You can also use them to determine which employees deserve reimbursement on expenses paid for with personal funds.

How to Deal With Business Expense Receipts Effectively

But what are the requirements for a valid business receipt? What’s the best way to record and file them, and for how long should you keep them? This post will discuss the requirements for a business expense receipt while pointing out any other things you need to know.

Business Expense Receipt Requirements

The IRS has specific requirements for an expense receipt to be considered valid. It must contain the following information:

- Transaction amount

The first detail that should be visible on the expense receipt is the transaction total, which is the amount used to pay for the expense.

- Transaction date

The receipts should also contain the date when the transaction occurred.

- Vendor’s name or place of transaction

The name of the vendor or service provider should be visible on the expense receipt. If not, the receipt can also indicate where the expense occurred.

- Purpose of expense

This part highlights the intention behind the purchase. What product or service did you get during the expense transaction? Some receipts, such as hotel bills, may not clearly project the purpose of the expense. In this case, you can validate the intention using your calendar.

If you usually pay for expenses using a credit card, it’s better to work with actual receipts in place of credit card statements. Credit card statements show the transaction amount, date, and vendor’s name, but they might fail to highlight the purpose of the expense. You can, however, couple your statements with your receipts to make them more valid.

Best Apps for Expense Receipts

There are many apps that you can use to capture expense receipts. Some apps function as accounting software, for example, QuickBooks Online. Others are receipt-focused, while others like Expensify are for expense management.

Here is a list of the best apps to scan and capture expense receipts:

This expense management software allows you to scan your receipts and capture all the necessary information. Expensify is available on Android, iOS, and as a web browser app, so it’s suitable for business owners that work remotely or travels a lot. Expensify lets you snap a picture of your receipts, then transfer the essential information to your expense report.

If you use a company credit card to pay for expenses, Expensify can automatically import the transactions from the card. You can also use this app to import expense transactions from service providers like Uber and Airbnb.

Although mainly an accounting software, QuickBooks Online has a receipt-scanning feature. This software allows you to upload receipts from your email, computer, and mobile device, then use them on your create expense transactions and reports. QuickBooks can also match your receipts to an expense already entered in your QuickBooks accounting software.

On top of receipt scanning, QuickBooks Online can also automatically import transactions from your credit card, PayPal, and bank statement. The software sorts your transactions and creates categories to ensure you trace your expenses easily and quickly.

Like Expensify and QuickBooks Online, Dext also extracts information from your receipts using optical character recognition (OCR). Once you snap a picture, this software application captures all the necessary details and allows you to edit it before saving it. You can also upload your receipt from your computer or email account. Dext is easy to use and is available on iOS and Android.

AutoEntry is ideal for business owners that don’t want the hassle of manually entering data into their accounting software. You can use this app to capture data from your receipts, invoices, and bank statements. AutoEntry also allows you to categorize your transactions and publish them to your accounting software whenever you need them.

How to File Receipts for a Small Business

Filing your receipts in an orderly manner helps you access them quickly when filing taxes or preparing financial statements. It’s better to organize your expense receipts as soon you receive them rather than wait for them to pile up on your desk. You can file them digitally or in hard copy. Whichever method you opt for, make sure you sort the business receipts into files and categories for easy tracking.

Check out these tips for filing and sorting your expense receipts:

- File the receipts by the expense type

This method works well if you have receipts for different types of expenses. For example, you may have expense receipts for office supplies, travel, phone and lunch transactions, and so on. You can store them in one file and categorize them according to the expense type. When a new financial year rolls in, open a new expense file and begin the sorting process again.

- File them chronologically

Another way to file receipts is in chronological order from the most to the least recent. This method is beneficial if there aren’t many expense types and if you want to file the receipts for a long time, for example, six years. You can allocate a file for each year and arrange them chronologically from January to December.

When filing receipts as hard copies, you may want to consider writing a few notes about the transaction on the back. If you have an audit, you can explain each expense by going over the written notes. For example, if you take a client out for lunch, write down the client’s name and the business discussed.

- Store them as digital receipts

Digital receipts eliminate the need to have paper backups. They are more accessible and are harder to lose or destroy. If you’d like to reduce the number of files and papers in your business, storing receipts in digital format is a good option.

Do You Need a Receipt for Every Business Expense?

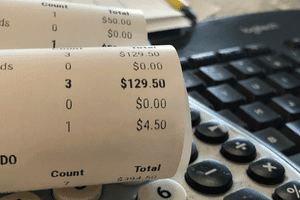

Depending on the number of expenses your business incurs, you can set your own threshold for keeping receipts. For example, you can choose to keep receipts for transaction amounts above $50.

Although, make sure your threshold is below $75. Anything higher than $75 will be considered non-compliance with the IRS guidelines. Alternatively, you can decide to keep all your receipts if storing them isn’t a burden to you or your employees.

How Long Should You Keep Your Business Receipts?

When it comes to keeping receipts, it’s better to store them for as long as the IRS requires them for an audit. The IRS usually audits records that go back three years, from the date of filing returns. Therefore, it’s safe to store your expense receipts for three years.

There are, however, some instances when the IRS may want receipts that date back more than three years. For example, if the IRS is auditing you for fraud, failing to file returns, or deducting worthless securities, you’ll be required to provide up to six years’ worth of expense receipts.

What To Do About Missing Business Expense Receipts?

If you lose your expense receipts, your first move should be to contact the vendor or service provider who issued them to you to request a copy. Most vendors will have no problem granting you a copy if they trace the receipt.

If this option doesn’t work, try validating the expense using other supporting documents. You can use canceled checks, bank or credit card statements, and your calendar to show proof of payment. Also, try and remember the exact details of the expense.

According to the Cohan rule (which came from a case in 1930), taxpayers with no receipts to support their business expenses can still claim deductions as long as the expense transaction is credible. The IRS may, however, not allow a full deduction. They might check the minimum standard price of the service or product you bought, then allow you to deduct that amount.

Conclusion

Filing business receipts is necessary for easy tracking when preparing financial statements or claiming tax deductions. For the expense receipt to be considered valid by the IRS, it should include the transaction amount, date, vendor’s name or location, and purpose of the expense.

Nowadays, you don’t have to keep your receipts as hard copies. You can scan and store them digitally with apps like Expensify, Receipt Bank, and QuickBooks Online. Whichever method you choose, ensure you sort and categorize the receipts so that you can easily access them whenever you need them.

You also don’t need to keep all your expense receipts. The IRS stipulates that you can store only those with a transaction amount higher than $75. This guideline does not apply to lodging expenses. You can set your own threshold, but make sure it is lower than $75.